Menu

Menu

Payroll processing plays a vital role within HR. It also represents a major responsibility for any organization, as ensuring employees receive their salaries accurately and on time is essential. Thus, organizations must establish a solid understanding of payroll and learn how to manage payroll processing efficiently. In this article, we will explore the fundamentals of payroll processing and outline the key steps involved.

Payroll is formally defined in two ways:

The amount of money paid to an employee is known as “net salary.” This figure represents the amount due to the employee after removing required deductions from the “gross salary.” Specifically, gross salary includes the base salary, any allowances, and any one-time benefits or payments.

Moreover, deductions can encompass regular sums, such as contributions to a savings scheme, or one-time payments, like the recovery of an overpayment. Additionally, statutory deductions, including taxes or regular pension contributions, may also apply. Ultimately, net pay, which is the amount transferred to the employee, equals gross income minus all deductions.

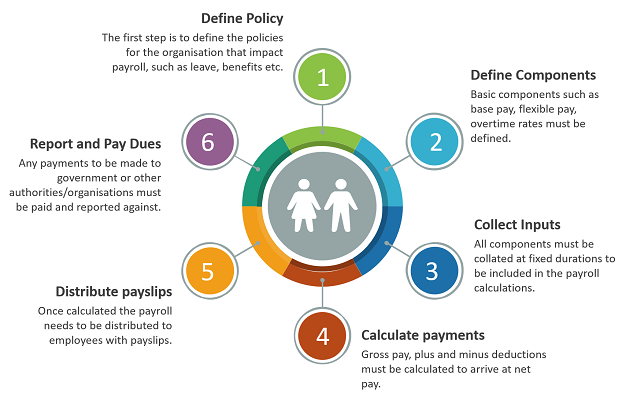

The function of establishing a payroll involves six critical steps, which can be organized into three distinct phases: what happens before, during, and after processing. First, in the pre-processing phase, essential tasks include gathering employee information, determining compensation, and calculating deductions. Next, during the processing phase, the actual payroll calculations occur, and the payroll is generated. Finally, in the post-processing phase, organizations must distribute paychecks, generate reports, and ensure compliance with relevant regulations. By understanding these phases, organizations can streamline their payroll processes effectively.

The organization must establish documented and approved payroll-related policies as a solid foundation. To achieve this, these policies must comply with local labor laws and incorporate essential elements such as time and attendance, leave, and benefits. Additionally, having clear policies in place helps ensure consistency and transparency, thereby fostering trust among employees. Ultimately, this proactive approach not only protects the organization from legal issues but also enhances employee satisfaction and engagement.

The organization must define core components that will build the payroll, including base salaries, salary scales, flexible salary rates, and overtime rates. By establishing these components clearly, the organization can ensure fair and competitive compensation for all employees. Moreover, having a well-defined structure enables better budget management and helps to attract and retain top talent. In addition, it creates transparency, allowing employees to understand how their compensation is determined, which ultimately fosters trust and satisfaction within the workforce.

Some smaller organizations still rely on manual payroll processing, often supported by spreadsheets. Conversely, larger organizations have invested in specialized payroll software or may even utilize outsourced payroll solutions. Regardless of the approach, the collated data needed for payroll calculations must be fed into the system used for processing. Once inputted, the payroll system applies deductions to gross salaries and calculates each employee’s net salary. Additionally, it provides total payroll data, allowing for accurate financial reporting and compliance with regulations. Therefore, investing in an efficient payroll system significantly enhances accuracy and streamlines the payroll process.

After completing and checking payroll calculations, organizations distribute salaries along with documentation summarizing gross salary, deductions, and net salary. This documentation is commonly known as a payslip. Depending on the organization’s policies, payslips may be paper-based or provided online and are typically distributed one month in arrears. Furthermore, salaries can be paid in cash, by cheque, or, more frequently nowadays, via bank transfer directly to the employee’s bank account. Since funds are released from the organization’s bank account, the person responsible for payroll must notify the bank each month about the payroll sum to be disbursed. Thus, effective communication with the bank is essential for timely salary payments.

In addition to the responsibility of paying employees, organizations must also fulfill any dues required by government entities or other organizations. For instance, money owed may include taxes or contributions to government pension schemes. Moreover, statutory requirements typically involve a level of reporting to relevant bodies to validate these payments. Furthermore, payroll must be accounted for as an operating cost for the organization and forms part of the audited accounts. Thus, organizations must maintain accurate records and ensure compliance with these financial obligations.

There are three main methods of managing payroll processing:

Small companies with few employees and standard salary profiles often use spreadsheets, such as Excel, for payroll processing. Typically, these spreadsheets feature defined macros that simplify processing and ensure accurate, consistent application of formulas and methods. Although using spreadsheets offers a low-cost option for managing payroll, it carries a higher risk of error due to reliance on manual data entry. Moreover, Excel-based processing becomes more challenging when rules or policies change, necessitating the redesign of spreadsheet macros to meet new requirements.

Specialised payroll software represents another common method for handling payroll processing. This software ranges from basic systems that manage all core payroll tasks to more sophisticated options that offer a higher level of data integration by handling payroll-related information such as time and attendance or benefits management. Furthermore, these systems often integrate seamlessly with other core HR systems, creating efficient workflows that enhance overall productivity.

Outsourced payroll processing involves submitting employee data to a contracted specialist external service provider, which processes payroll and manages compliance on behalf of the organization. This approach effectively manages this critical aspect of the business, eliminating the need for organizations to maintain specialized skill sets, ensuring compliance with the latest legislation, and reducing the risk of processing errors. However, organizations must select a reputable and professional partner as their service provider to ensure reliability and quality.

Payroll can be a complicated and time-consuming activity, and it is subject to human error during processing. Moreover, it requires specialized skills and up-to-date knowledge of the latest relevant legislation. Consequently, organizations often face challenges in maintaining accuracy and compliance, which can lead to potential legal issues and financial penalties. Thus, investing in reliable payroll systems or outsourcing this function can significantly mitigate these risks and enhance efficiency.

Efficient payroll processing offers numerous advantages beyond timely salary payments. First, it fosters employee satisfaction and trust. When employees receive their salaries accurately and on time, their morale and productivity increase. Additionally, timely payments demonstrate the organization’s commitment to valuing its employees, strengthening loyalty. Moreover, a well-organized payroll system minimizes errors and reduces the administrative burden on HR staff. This streamlined process allows HR professionals to focus on strategic initiatives that contribute to growth, such as employee development and engagement programs. Furthermore, maintaining compliance with labor laws and regulations prevents potential legal issues, protecting the organization from costly fines. In the long run, efficient payroll processing improves operational efficiency and fosters a positive organizational culture.

Despite its importance, payroll management presents challenges. One significant hurdle is frequent changes in labor laws and tax regulations. Organizations may struggle to keep up with the latest tax rates or mandatory deductions, leading to inaccuracies. Additionally, as organizations grow, the complexity of payroll processing increases. Managing various employee contracts, benefits, and deductions becomes difficult. Furthermore, outdated systems can introduce inaccuracies and inefficiencies into the payroll process. Consequently, these challenges highlight the need for a robust payroll strategy that adapts to changing circumstances. Organizations must remain vigilant and continuously adjust their payroll strategies to meet evolving demands while ensuring accuracy and compliance.

To optimize payroll processing, organizations should adopt several best practices. First, maintaining up-to-date payroll policies is essential for consistency. Regularly reviewing policies ensures alignment with current laws and organizational goals. Furthermore, training HR staff on the latest payroll software and legal requirements keeps them informed. Implementing a robust validation process for payroll data helps catch errors before payroll runs, enhancing accuracy. For instance, cross-referencing data from various sources can identify discrepancies early on. Additionally, organizations should leverage technology by investing in integrated payroll solutions. These solutions streamline workflows and reduce human error. By automating repetitive tasks, HR professionals can focus more on strategic initiatives, such as enhancing employee engagement and retention. Following these best practices creates a reliable payroll system that supports operational efficiency.

Looking ahead, payroll processing will likely evolve due to technological advancements. Automation and artificial intelligence will enhance efficiency, accuracy, and compliance in payroll management. For example, AI-driven payroll systems can analyze data and predict discrepancies, enabling proactive adjustments. Cloud-based payroll solutions will provide flexibility, allowing organizations to access payroll information from anywhere. This accessibility empowers HR teams and enhances communication with employees regarding payroll queries. Furthermore, as more employees demand transparency and control over their compensation, self-service portals will become popular. These portals will empower employees to manage payroll details independently and view payment history. Embracing these trends positions organizations to meet workforce needs while improving payroll processing efficiency. Ultimately, the future of payroll processing promises to be more efficient, employee-centric, and adaptable to the changing business landscape.

Our HRBluSky platform provides seamless payroll processing integrated with other modules and external service providers through the WPS electronic salary transfer system. Moreover, HRBluSky incorporates UAE labor laws, employee recruitment, visa management, insurance, and end-of-service benefits costs. By including these elements in the system, you can track hidden employee costs more effectively and support accurate forecasting for your HR budget.

Alignment

Article

Audit

Automation

Benefits

Candidate

Communication

Compliance

Digitalisation

Digital Technology

Diversity

Emirates Id Application

Employee Experience

ESS

Feedback

Health and Safety

HRMS

HR Strategy

HR System UAE

Human Resource Management

Human Resource Management Systems

Job Roles

Learning and Development

Onboarding

Outsource

Payroll

Payroll Management System

Payroll Processing

Performance

Performance Management

Personalisation

Recruit

Recruiting

Recruitment

Remote Working

Rewards

Security

Service Providers

Skills

Smart

Survey

Virtual

Visa Cancellation

Work Environment

Workforce

© 2026 Pruvity HR Solutions Pvt Ltd, Madurai, India